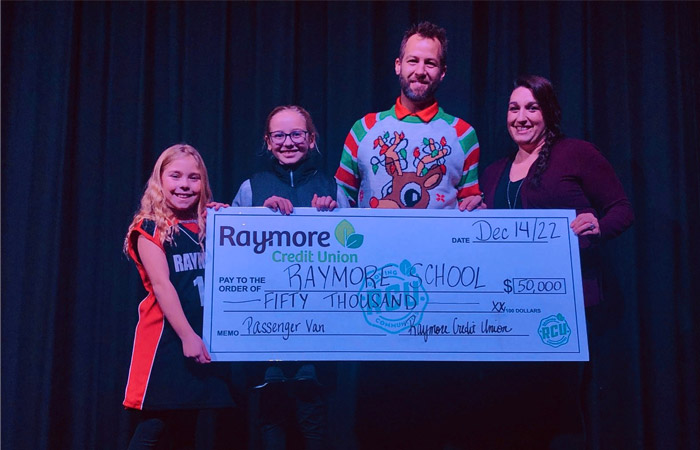

RCU Gives Back!

Raymore School Community Council (SCC) along with the staff and students at Raymore School have been working hard this year fundraising for a 15-passanger van. This van will be available to staff and students to utilize for travel for classroom activities, extracurricular activities and such.

The RCU recognize their efforts. The work that goes into these fundraisers has not gone unnoticed!

We are excited to help them with their fundraising efforts to purchase the van with a $50,000 donation!